Contributed by Rangle.io

Introduction

We’re living in a digital-first reality, and more fintech companies are disrupting the banking and financial services sector with technology, leaving traditional banks struggling to keep up.

Why? Because many traditional banks are still operating on legacy monolithic systems with strict regulations and outdated core platforms. For example, many banks still rely on COBOL—a programming language devised in the 1950s—making it extremely hard to innovate.

To keep up with the pace of fintech, legacy banks need to have the same agility and flexibility that their outdated legacy monolithic platforms and systems cannot provide.

How can traditional banks catch up? It’s time to consider migrating to a composable digital experience platform (DXP).

What is composable DXP?

According to Gartner, a DXP is “an integrated set of core technologies that support the composition, management, delivery, and optimization of contextualized digital experiences”.

Many organizations are now taking strides toward composable DXP architectures, and banks should follow suit.

A new way to deliver products and services

The COVID-19 pandemic dramatically reshaped how banks interact with customers and vice versa. Customers’ expectations changed, and banks were forced to shift how they delivered products and services. Banks needed to invest more in marketing and build new, or better, customer touchpoints across their digital channels.

This is where the composability of a DXP renders itself beneficial.

The beauty of this type of DXP is that it’s composed of a series of solutions connected through APIs and leverages an intelligent microservices architecture—a type of application architecture that provides a framework to develop, deploy, and maintain services independently, according to Google.

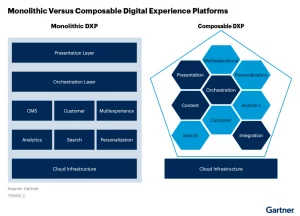

One of the main differentiators between a composable DXP and a legacy monolithic system is that the front and backend components are decoupled. On top of increased capabilities to build better touchpoints and more integration with APIs, here are three reasons why traditional banks should migrate to a composable DXP:

3 reasons why banks should migrate to a composable DXP

A composable DXP sets the foundation for managing content

For banks with multiple divisions, products, and services (personal and commercial banking, wealth management, capital markets, etc.), a DXP can help link products together. This makes it easy to find and update different assets and modules on the site, enabling faster editing experiences and the ability to manage content for multiple channels.

A DXP is a central hub that can help bring the bank’s marketing stack together. Instead of having independent services and solutions for managing content, marketing automation, e-commerce, and analytics, marketing teams can add APIs to serve content.

In the past, marketing teams would have to submit Jira tickets to their development or IT teams to make changes to the content on their organization’s site. The flexibility of a composable DXP gives more power to marketers and reduces the load on development and IT teams. Developers can now focus on picking the best tools, platforms, utilities, and work in their stack; while marketing teams can assemble content from building blocks, components, and presets.

One of the big six banks we worked with is now saving millions of dollars because their developers are not spending countless hours fixing marketing requests. Instead, with a composable DXP, they can now focus on creating efficiency.

A composable DXP helps build better relationships with customers

Banks need to keep customer satisfaction, loyalty, and retention top of mind, and a DXP is essential for delivering personalized customer experiences across different channels and touchpoints. Let’s explore two scenarios:

Scenario 1: A traditional bank that still operates on a legacy platform

Let’s say Mark, a 60-year-old VP of a large tech firm is preparing for retirement. He has a family, a house in the suburbs, and a small business on the side. When he logs into his banking app, he sees an ad for a first-time homebuyer allowance. Given his profile, we know he’s a homeowner, so why is this ad showing up on his app?

The problem with many traditional banks is that there’s no personalization, and the content isn’t catered to the customer. Many banks say they’re “digital” but still operate on a monolithic system—there’s no personal touch with how they communicate with their customers. Customers expect their banks to have a solid understanding of who they are. Without personalization, banks risk alienating their current customer base, leaving the door open for superior customer experiences of other banks to be explored.

Scenario 2: A bank has migrated to a composable DXP

Now, let’s say Mark is logging into his banking app—but this time, the bank has migrated to a composable DXP. When he logs in, the first thing he sees is a banner displaying investment and retirement savings options for seniors. He sees options to learn more about Registered Retirement Income Funds (RRIFs) and Guaranteed Investment Certificates (GICs).

In this scenario, the content is personalized and relevant to Mark. This shows that the bank truly knows its customers, providing consistent, immersive experiences. The result leads to increased loyalty and revenue.

A composable DXP provides a single source of truth for sharing data

With a composable DXP, banks can easily share data from a single source of truth—this means you don’t have to worry about presentations being different due to data pulled from different independent sources. A composable DXP is meant to be the one and only organizational data source, a repository of information that all teams can pull from.

Since a composable DXP can be the single source of truth, banks can eliminate any overlapping technologies in their stack—it’s cost-efficient, and teams across the organization can focus on what they do best while eliminating technological silos.

Migrating to a composable DXP enables banks to connect all digital aspects of the organization to create unified, cohesive customer journeys and experiences.

Rangle’s experience in the financial services industry

DXPs have evolved over time to keep up with changing digital consumer demands, and banks need to do the same. At Rangle, we’re helping banks transform the way they’re delivering seamless customer experiences. With our robust technology stack, we ensure the teams we work with are equipped with the right tooling to achieve composable DXP success.

“Too many companies are blocked by their CMSes. They were told that investing in these products would negate the need for more engineers and IT professionals, but they’re finding that the reverse is true. Our goal is to help clients achieve a modern digital experience platform that takes care of much of the costly and confusing decision making.” – Bertrand Karerangabo, Chief Strategy Officer at Rangle.io

For banks that are considering migrating—or have already migrated—to a DXP, here is our CEO Nick Van Weerdenburg’s four non-negotiable attributes for DXP success:

- A DXP is both comprehensive and open-ended

- Marketing and merchandising teams can build experiences without help from a shared services team

- Testing is safe, and it becomes the norm

- Reversible actions mean there are no mistakes, just bigger or smaller successes

If you want to learn more about how to create a true composable DXP, integrating your CMS platform with your design system and operations practices, reach out here for a conversation and assessment of your unique digital context.

About Rangle.io

Rangle is a strategic partner for enterprise organizations and scale ups, solving their most complex challenges at the intersection of technology and product management. Our experts are hands-on, working directly with our clients’ practitioners, embedding in the business to co-create the goals, growth strategy and processes.

To learn more about Rangle.io visit: https://rangle.io/